The Ultimate Guide to Locating the very best Tough Cash Lenders

Navigating the landscape of difficult money loaning can be an intricate undertaking, needing a detailed understanding of the various aspects that add to an effective loaning experience. From examining lenders' credibilities to comparing rate of interest and costs, each action plays a vital duty in safeguarding the very best terms feasible. Additionally, establishing reliable interaction and presenting a well-structured business plan can considerably affect your interactions with loan providers. As you think about these aspects, it ends up being obvious that the course to identifying the appropriate tough cash lending institution is not as straightforward as it may seem. What essential insights could additionally boost your strategy?

Understanding Hard Money Financings

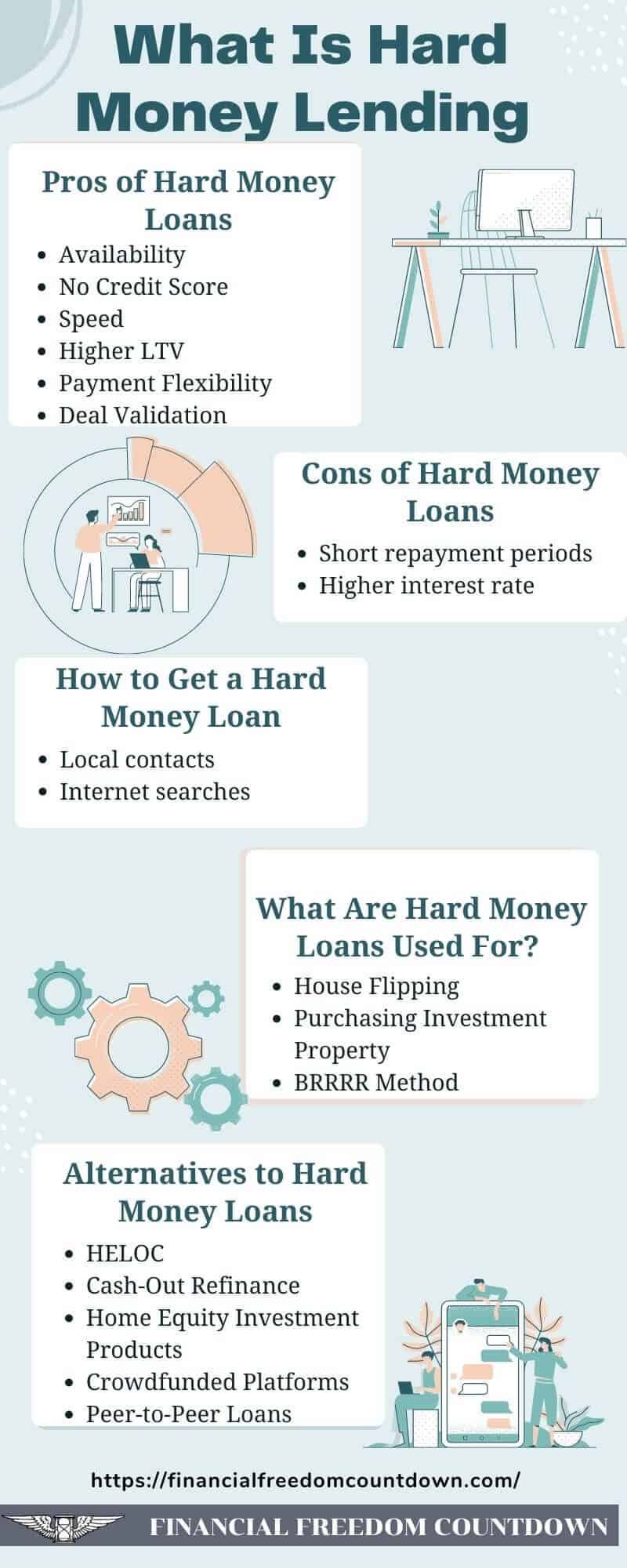

Among the defining attributes of difficult money fundings is their reliance on the value of the property as opposed to the debtor's creditworthiness. This allows customers with less-than-perfect credit score or those seeking expedited financing to access capital more readily. In addition, hard cash car loans typically include greater rates of interest and shorter settlement terms compared to standard finances, showing the enhanced risk taken by lending institutions.

These finances offer various objectives, including funding fix-and-flip tasks, refinancing troubled residential properties, or providing capital for time-sensitive possibilities. As such, understanding the subtleties of hard cash finances is essential for financiers that intend to utilize these economic instruments effectively in their actual estate endeavors.

Key Elements to Think About

Following, consider the terms of the car loan. Various loan providers use differing passion prices, costs, and repayment routines. It is essential to recognize these terms fully to stay clear of any undesirable shocks later. Furthermore, examine the lender's funding rate; a quick approval process can be crucial in competitive markets.

An additional crucial aspect is the loan provider's experience in your certain market. A loan provider aware of local problems can provide important understandings and could be a lot more flexible in their underwriting process.

How to Assess Lenders

Reviewing difficult money lenders entails a systematic method to ensure you choose a partner that straightens with your investment objectives. Start by examining the lending institution's online reputation within the market. Look for testimonials, testimonials, and any available scores from previous customers. A reliable lender needs to have a history of successful transactions and a solid network of completely satisfied debtors.

Next, check out the lender's experience and field of expertise. Different loan providers may concentrate on various kinds of residential properties, such as property, industrial, or fix-and-flip projects. Select a loan provider whose expertise matches your financial investment approach, as this understanding can dramatically influence the authorization procedure and terms.

Another important element is the lender's responsiveness and communication design. A dependable lender should be ready and available to answer your inquiries comprehensively. Clear interaction throughout the assessment process can indicate exactly how they will manage your lending throughout its period.

Lastly, ensure that the lender is clear concerning their procedures and demands. This consists of a clear understanding of the paperwork required, timelines, and any kind of problems that might use. Taking the time to assess these facets will equip you to make an informed check my site choice when selecting navigate to this website a hard money lender.

Comparing Rate Of Interest and Fees

A comprehensive contrast of rate of interest and fees among hard cash lending institutions is essential for optimizing your investment returns. Tough cash finances typically come with higher interest rates contrasted to standard financing, generally ranging from 7% to 15%. Comprehending these rates will certainly help you examine the possible prices related to your investment.

In enhancement to rates of interest, it is critical to evaluate the linked charges, which can dramatically impact the general funding price. These costs may include source charges, underwriting costs, and closing costs, typically shared as a percentage of the car loan quantity. Origination charges can vary from 1% to 3%, and some loan providers may charge added fees for processing or administrative jobs.

When contrasting loan providers, think about the overall cost of borrowing, which incorporates both the passion prices and charges. Be sure to inquire concerning any kind of possible prepayment penalties, as these can influence your capability to pay off the funding early without incurring additional costs.

Tips for Effective Loaning

Understanding interest prices and costs is only part of the equation for securing a tough money car loan. ga hard money lenders. To guarantee successful borrowing, it is essential to completely examine your financial scenario and job the prospective roi. Beginning by clearly specifying your loaning purpose; lending institutions are more probable to react favorably when they recognize the intended use the funds.

Following, prepare an extensive organization plan that details your project, anticipated timelines, and financial forecasts. This shows to loan providers that you have a well-balanced technique, boosting your integrity. Additionally, preserving a solid relationship with your loan provider can be beneficial; open communication cultivates trust and can cause more beneficial terms.

It is additionally important to make sure that your residential property meets the lender's requirements. Conduct a detailed appraisal and that site offer all called for documents to streamline the approval procedure. Be conscious of leave approaches to repay the lending, as a clear payment plan assures loan providers of your dedication.

Final Thought

In summary, finding the most effective difficult money loan providers requires a complete exam of numerous elements, including lender credibility, finance terms, and field of expertise in building kinds. Reliable examination of lending institutions with comparisons of rate of interest rates and fees, combined with a clear company plan and strong interaction, boosts the probability of positive borrowing experiences. Ultimately, diligent research and critical interaction with loan providers can result in effective economic results in real estate undertakings.

In addition, difficult cash financings normally come with higher passion prices and shorter settlement terms contrasted to conventional financings, showing the increased threat taken by lenders.